In a rare moment of bipartisan cooperation, the United States Senate just took a dramatic step that could reshape the digital economy and redefine how cryptocurrency operates within American borders. The decision, buried among a series of high-stakes votes this week, marks a turning point for both financial regulation and technological innovation. But it also opens the door to new political clashes, deeper ideological debates, and an intensifying battle over the future of money itself.

What exactly happened on the Senate floor—and why is it sending shockwaves through the crypto world and beyond?

Let’s break it all down.

A New Chapter for Cryptocurrency: The GENIUS Act Passes the Senate

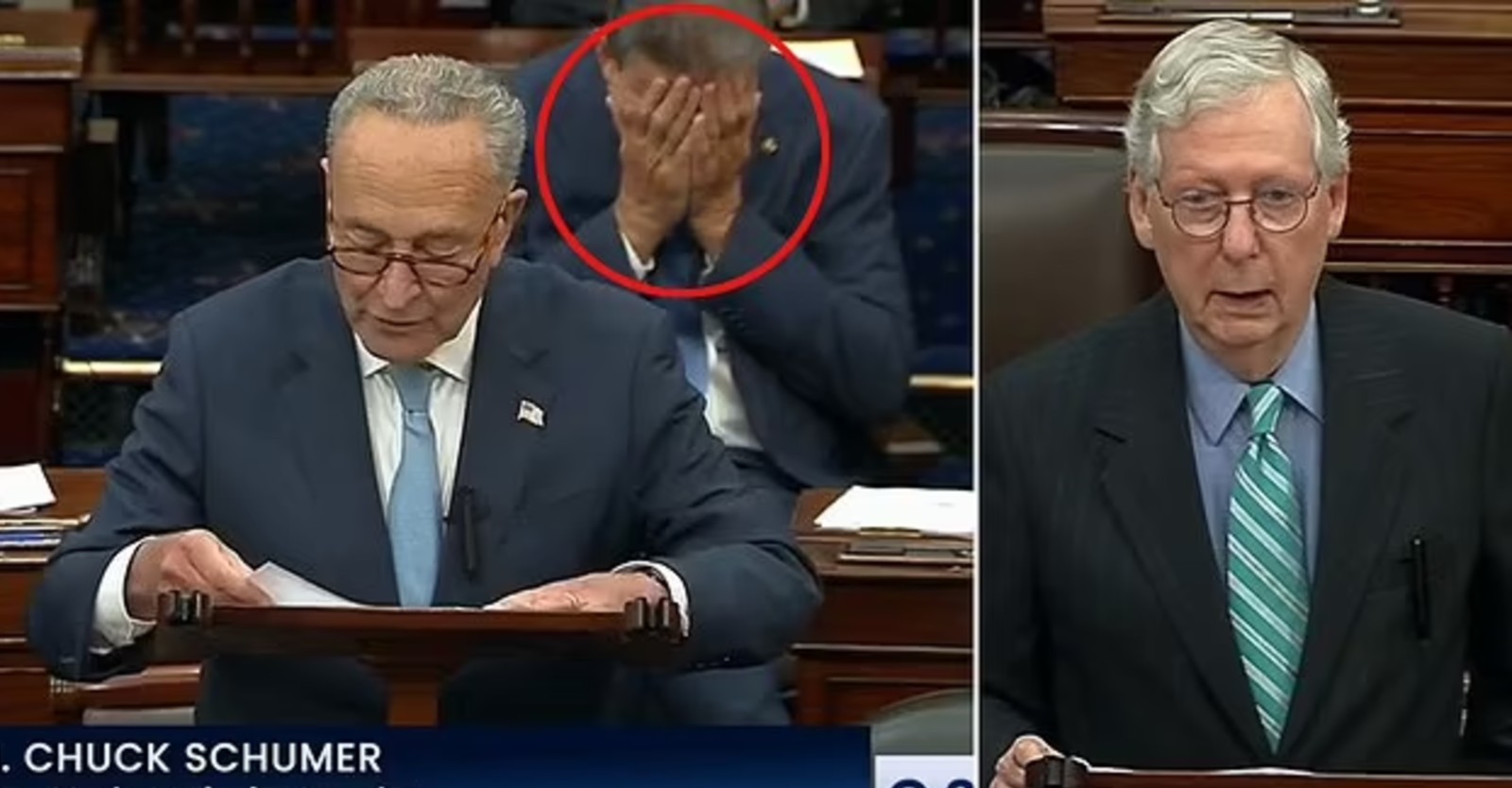

After months of lobbying, political negotiation, and uncertainty, the U.S. Senate passed the GENIUS Act, a groundbreaking bill aimed at creating the country’s first comprehensive regulatory framework for stablecoins—a type of cryptocurrency tied to the U.S. dollar or other traditional assets.

The legislation passed by a 68–30 vote, earning support from several Democrats and the majority of Senate Republicans. It now heads to the Republican-controlled House of Representatives before it can reach President Donald Trump’s desk for final approval.

For the cryptocurrency industry, the moment is being celebrated as a landmark victory.

“It is a major milestone,” said Andrew Olmem, a former deputy director of the National Economic Council under Trump and now a managing partner at Mayer Brown. “It establishes, for the first time, a regulatory regime for stablecoins, a rapidly developing financial product and industry.”

What Are Stablecoins—and Why Do They Matter?

Stablecoins are a type of cryptocurrency designed to maintain a stable value, often pegged 1:1 to the U.S. dollar. Unlike volatile cryptocurrencies like Bitcoin or Ethereum, stablecoins are often used as digital equivalents of cash, allowing traders and users to move funds quickly between platforms or across borders with minimal fluctuation in value.

They are also central to a range of new technologies, including decentralized finance (DeFi) applications and global payment systems.

Supporters say stablecoins could offer:

-

Faster, low-cost international payments

-

Digital access to dollars for people in unstable economies

-

Tools for innovation in fintech and online banking

However, critics have long raised concerns about transparency, regulatory gaps, and the potential for misuse, including in money laundering, terrorist financing, or market manipulation.

What the GENIUS Act Actually Does

The GENIUS Act introduces a detailed regulatory framework for stablecoin issuers, with several key requirements:

-

Backing by Liquid Assets

All issued stablecoins must be backed 1:1 by liquid reserves—such as U.S. dollars or short-term Treasury bills. -

Monthly Disclosures

Issuers must publicly disclose their reserve compositions every month, offering transparency to regulators and users. -

Licensing Requirements

Only licensed entities will be permitted to issue stablecoins, helping to limit risks from foreign or anonymous entities. -

Audit Standards

Independent audits will be mandatory, ensuring that issuers are not engaging in fractional reserve practices or deceptive reporting. -

Federal Oversight

The bill gives the Federal Reserve and other U.S. financial agencies authority to monitor and enforce compliance among stablecoin issuers.

A Billion-Dollar Industry, Now Under Scrutiny

The stablecoin industry has grown at an explosive pace, with popular tokens like Tether (USDT) and USD Coin (USDC) reaching hundreds of billions in circulation globally. But with that growth came scrutiny.

Some issuers have been accused of misrepresenting their reserves, while others have operated outside U.S. regulatory reach. At the same time, crypto lobbying in Washington has surged, with companies spending over $119 million to support pro-crypto lawmakers in last year’s elections.

Now, with regulatory clarity on the horizon, major firms are likely to either adapt—or exit the U.S. market entirely.

Political Reactions: Unity… with Undercurrents of Tension

While the bill passed with bipartisan support, not everyone was thrilled with its contents or implications.

Senator Elizabeth Warren, a vocal critic of crypto markets, blasted the bill’s perceived loopholes in a fiery floor speech last month:

“A bill that turbocharges the stablecoin market, while facilitating the president’s corruption and undermining national security, financial stability, and consumer protection is worse than no bill at all.”

She and several other Democrats demanded stricter anti-money laundering provisions, along with rules preventing foreign tech companies or non-U.S. entities from issuing private stablecoins in American markets.

Despite this, moderate Democrats joined Republicans in passing the measure, signaling an emerging consensus that the crypto sector can no longer exist in a legal vacuum.

Trump’s Influence and the Road Ahead

President Trump, who once expressed skepticism toward Bitcoin, has taken a pro-crypto pivot in recent years—particularly during his 2024 campaign, where he courted tech innovators and digital asset investors as a new economic constituency.

The White House has expressed urgency in passing the stablecoin bill into law before August 2025, with Bo Hines, Trump’s digital assets adviser, pushing hard for a finalized version of the bill within weeks.

Trump himself is expected to sign the GENIUS Act into law if it clears the House, where GOP support is even stronger than in the Senate.

This shift reflects Trump’s broader attempt to align the U.S. with crypto-friendly jurisdictions and ensure that American capital markets remain globally competitive as digital currencies become more mainstream.

A Busy Week in the Senate: Ambassadors and Alliances

The Senate’s approval of the stablecoin bill wasn’t the only headline this week. In a busy flurry of decisions, the chamber also confirmed three major ambassadorial appointments, all put forward by President Trump.

Each new appointee is a billionaire businessman with longstanding Republican ties:

-

Warren Stephens – Confirmed as U.S. Ambassador to the United Kingdom and Northern Ireland by a 59–39 vote.

-

Tom Barrack – Confirmed as U.S. Ambassador to Turkey, winning approval with a 60–36 vote.

-

Tilman Fertitta – Confirmed as U.S. Ambassador to Italy, with an overwhelming 83–14 Senate vote.

All three men are known for their influence in Republican circles and their personal friendships with the president. They are expected to play high-profile roles in trade diplomacy, cultural outreach, and military cooperation over the next few years.

What This Means for the Crypto Industry

With Senate passage of the GENIUS Act and White House backing, the crypto industry now stands on the edge of a new era—one where regulatory legitimacy might finally match technological ambition.

Some potential implications include:

-

Institutional Adoption: With clear rules, traditional banks and investment firms may become more comfortable adopting stablecoin technology.

-

Consumer Protection: Transparent reserve requirements and audits could limit the risk of future collapses like the Terra-LUNA crisis.

-

Innovation Acceleration: Regulatory clarity could unleash new development in payments, lending, smart contracts, and cross-border transactions.

-

Market Consolidation: Smaller or opaque issuers may be pushed out, leading to a more centralized—but arguably safer—ecosystem.

Yet, critics warn of overreach, surveillance, and the potential stifling of decentralized technologies if regulation becomes too tight or politicized.

The Global Picture: Other Nations Watching Closely

As the United States moves forward, international regulators are paying close attention. Many nations, including the EU, Japan, and Singapore, have already rolled out stablecoin frameworks or are in the process of drafting them.

If the GENIUS Act succeeds, it could become a template for global standards, helping to establish a universal set of best practices around reserves, disclosures, and risk management.

Conversely, failure to enforce strong oversight could inspire regulatory arbitrage, where unstable or unethical issuers simply relocate to less-stringent countries.

Final Thoughts: From Wild West to Wall Street?

The U.S. Senate’s vote on the GENIUS Act marks a seismic moment in financial history. What was once a niche corner of internet culture—stablecoins and crypto assets—has now officially entered the realm of regulated financial infrastructure.

Whether this leads to greater adoption, tighter enforcement, or unexpected consequences will depend on how the bill is implemented—and how the public, the markets, and political leaders respond.

For now, the message is clear: crypto is no longer underground. It’s headed straight for the center of the world economy.